Description

Product Format : Webinar

Duration : 90 minutes

Aired Time : Available All Day – OnDemand

Speaker : Vicki Lambert

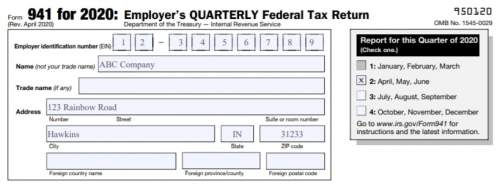

Updated Form 941 IRS. Form 941, and the related Form 941X used to correct a previously filed Form 941, present special compliance and reconciliation issues. Correction of prior return errors on a 941 can be challenging and subject to strict deadlines to avoid incurring penalties or interest charges.

16 new lines now appear on this form along with changes to two others! Are you ready to meet these changes and handle them correctly?

Here are just some of the new items you must now know and understand:

- What has changed in Line 11?

- Where do you enter your total non-refundable credits?

- Where do you enter the deferred amount of the employer share of social security tax?

- Where do you enter total deposits, deferrals, and refundable credits?

- What is entered on Line 22?

This webinar covers the IRS Form 941 and its accompanying Form Schedule B for 2020. It discusses what is new for the form in 2020 and covers the requirements for completing each form line by line. It includes the filing requirements and tips on reconciling and balancing the two forms. The webinar also covers the forms used to amend or correct the returns.

Join this session with expert Vicki Lambert, as she helps you understand the new Updated IRS Form 941 and its accompanying FormSchedule B (1040A or 1040).

Session Highlights:

- For the attendee to understand the requirements for completing the 2020 Form 941 correctly line by line.

- To ensure that the attendee has the basic knowledge to complete the Form Schedule B according to the IRS regulations and to ensure that it reconciles down to the penny with the Form 941 prior to submission.

- To ensure the attendee knows when a Form 941-X is required and provide the attendee with the basic knowledge of how to complete Form 941-X.

- To demonstrate to the attendee the reconciliations needed under IRS and Social Security Administration regulations.

Webinar Agenda

- What’s New for Q2-Q4 2020

- Families First Act: Credits for Paid Sick Leave and Paid Family Leave

- CARES Act: including deferring Employer’s Social Security

- IRS Form 7200: Purpose for the form and how it applies to you

- Line by line review of the massive changes of the New Revised Form 941

- And more!

Why Should You Attend:

Businesses typically need to file Form 941 if they have employees and withhold income tax, social security, and Medicare tax from their wages.

Specifically, you need to file form 941 to report the following payroll-related amounts. If any of these factors apply to your business, you need to file Form 941.

- Wages paid

- Tips reported to you by employees

- Federal income tax withheld

- Employer and employee share of social security and Medicare taxes

- Any additional Medicare Tax withheld from employees

- Current quarter adjustments to Medicare taxes and social security for sick pay, tips, group-term life insurance and fractions of cents

- Small business payroll tax credit

Collection and enforcement of federal employment taxes is a current priority for the IRS.

The quarterly Form 941 reports employee headcount, wages and tips, taxes withheld from employee pay and employer taxes, and tax liability dates that establish due dates for tax deposits. It is the basis for IRS determination of employer compliance with the requirement to withhold and deposit employee income tax and Social Security and Medicare taxes. The tax liability section and Schedule B provide the basis for IRS assessment of deposit penalties.

Who Should Attend:

- Payroll Executives/Managers/Administrators/Professionals/Practitioners/Entry Level Personnel

- Human Resources Executives/Managers/Administrators

- Accounting Personnel

- Business Owners/Executive Officers/Operations and Departmental Managers

- Lawmakers

- Attorneys/Legal Professionals

- Any individual or entity that must deal with the complexities and requirements of Payroll compliance issues

This event brought to you by WebinarPlanet.com

(WiseQuestion is learner supported. When you buy through links on our site, we may earn an affiliate commission)