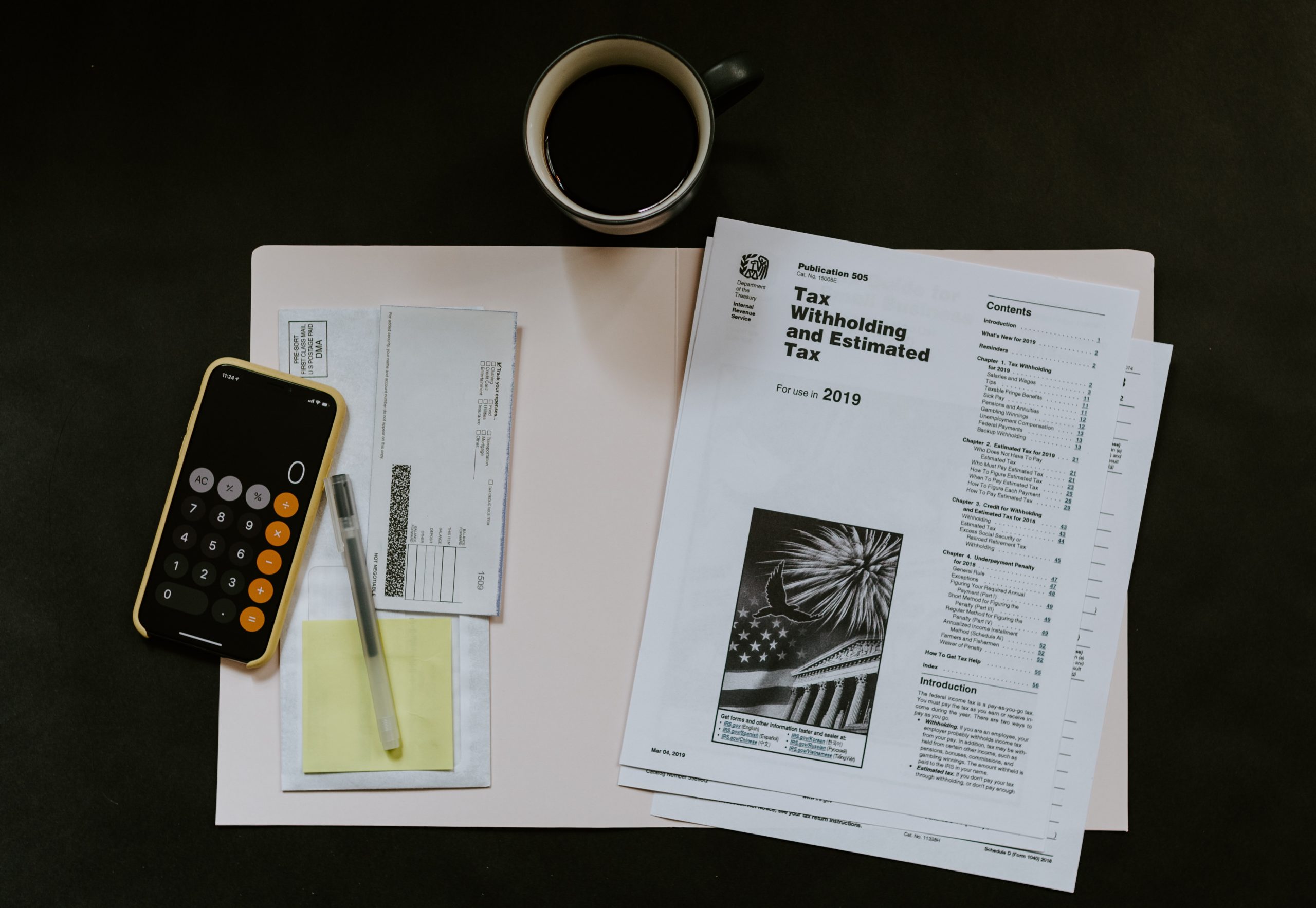

NOW is the time to focus on 2019 ACA reporting for the IRS The Affordable Care Act was passed in

...Continue reading2020 Overtime Update – What should my business do now?

Employers playbook on the 2020 Overtime Update First the good news. Employers have till January 2020 to prepare for the

...Continue readingW 4 form strikes back – 2020 Payroll Updates

How Will The Form W-4 Update Affect Employers? Earlier this year, IRS released an update on Form W-4 and while

...Continue readingPayroll Taxes & Deductions

Your legal requirements as an employer. Because the US tax laws are so confusing, you might also want to talk

...Continue readingDo you know your Mandatory And Voluntary Payroll Deductions?

Payroll deductions that impact the paycheck you take home. Under US Labor laws, wages earned by an individual are that

...Continue readingEEO-1 Component 2 Deadline Extended

The EEOC announced that September 30, 2019, is no longer a hard deadline for employers to submit pay and hours-worked

...Continue readingOSHA & Women in Construction

How Does OSHA Protect Women In Construction? When Schillivia Baptiste earned her bachelor’s degree in civil engineering from New York

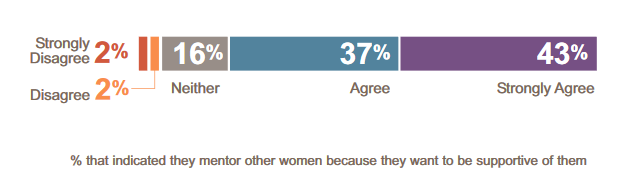

...Continue readingWomen as Mentors. What Research says.

Research via Images Here is a succinct view of what research surveyed a total of 318 businesswomen from 19 different

...Continue readingDo Women Make Good Mentors For Other Women?

There have always been these lengthy conversations about how women have to work extra hard, sacrifice a lot more and

...Continue readingChild tax credit to fund time off – FMLA alternative

Bi-partisan paid leave plan creates no employer mandate for paid family leave Child care in America has become increasingly inaccessible.

...Continue reading