I believe in giving credit where credit is due, and I’ll be damned if the IRS doesn’t deserve some serious credit. It was less than 13 months ago that Congress dumped 500 pages of sloppy statutory language on the Service in the form of the Tax Cuts and Jobs Act, and somehow, in that span the IRS has managed to provide final regulations on the most controversial, convoluted and complicated provision of the new law: Section 199A, better known as the “20% pass-through deduction.” It required a Herculean effort, particularly when you consider that, you know…most of the government has been on unpaid leave since December 22nd.

Before final regulations could be published, a LOT had to happen. First, of course, proposed regulations had to be issued, and the Service delivered on that front back in August, publishing 184 pages of thorough, carefully-considered interpretation of the statute. That’s not to say that the proposed regulations were perfect of course, but no proposed regulations are.

In response to those proposed regulations, the IRS received over THREE HUNDRED AND THIRTY comment letters from tax professionals and taxpayers, including the now-famous and forever-demeaning submission that read simply: You. Are. Dumb. Attorneys at the Service were charged with considering each of those comments — hurtful as they may have been — and using them to guide the crafting of final regulations.

All of this, of course, was to be done with an overwhelming sense of urgency, because the 2018 tax filing season is slated to begin on January 28th, and well….people tend to have an easier time filing their returns when they understand how the law actually works. Despite those onerous expectations, the IRS delivered once again, publishing 274 pages of final regulations — along with two key Revenue Procedures — yesterday afternoon. A Herculean effort, indeed.

Now that we’ve got our hands on the final guidance, we can, at long last, take a comprehensive look at the new 20% pass-through deduction. Let’s see what those final regulations have to say, highlighting the key changes from the proposed regulations for those who’ve been following along throughout the process. But first, let’s remind ourselves of the statutory background.

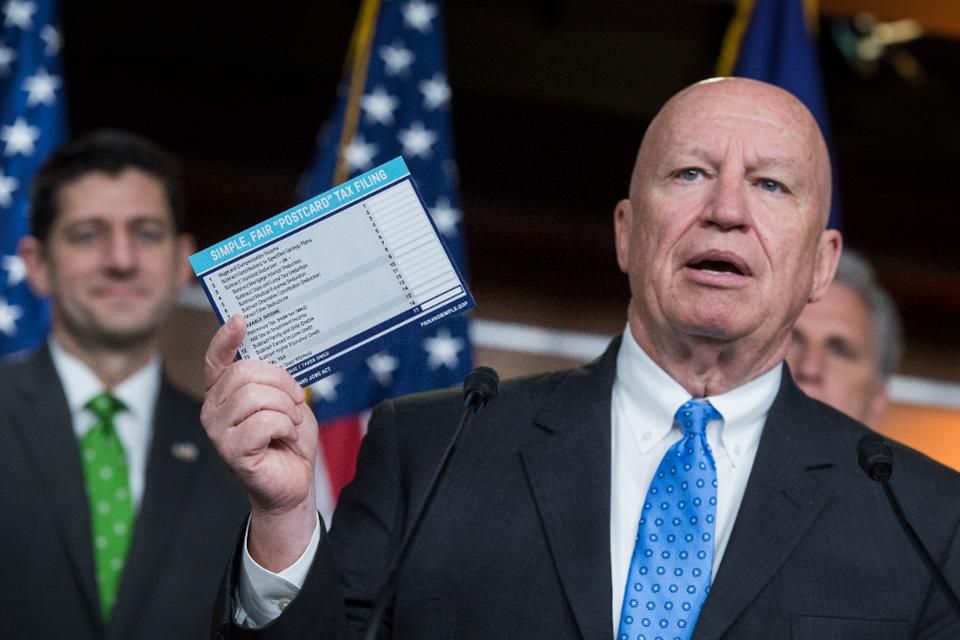

Last April, then House Ways and Means Chairman Rep. Kevin Brady, R-Texas, displayed a sample of a postcard-style tax filing as an example of the GOP tax overhaul’s simplification. But there’s nothing simply about new Section 199A. (Photo by Tom Williams/CQ Roll Call)

Section 199A, In General

First things first…like (nearly) all the individual provisions in the Tax Cuts and Jobs Act, Section 199A is effective for tax years beginning after December 31, 2017 and before January 1, 2026. Come 2026, the provision expires, so enjoy trying to understand this while the little voice in your head constantly reminds you that all of this might cease to exist in eight years.

The provision is actually comprised of three separate deductions. The third we can mention once in this space, and then cast it aside for the remainder of the article, as it is a deduction that applies only to specified agricultural and horticultural cooperatives. Don’t get me wrong…it’s an important deduction, but it’s niche enough that we won’t cover it here. Rather, it is the first two deductions offered by Section 199A that have garnered all of the attention and need for guidance.

The first deduction is the one that likely brought you to this article: the “20% pass-through deduction.” In its most simple terms, Section 199A grants an individual business owner — as well as some trusts and estates — a deduction equal to 20% of the taxpayer’s qualified business income. For business owners with taxable income in excess of $207,000 ($415,000 in the case of taxpayers married filing jointly), however, no deduction is allowed against income earned in a “specified service trade or business.” In addition, at these same income levels, the deduction against income earned in an eligiblebusiness is limited to the greater of:

- 50% of the taxpayer’s share of the W-2 wages with respect to the qualified trade or business, or

- The sum of 25% of the taxpayer’s share of the W-2 wages with respect to the qualified trade or business, plus 2.5% of the taxpayer’s share of the unadjusted basis immediately after acquisition of all qualified property.

Once this deduction is computed and limited, as appropriate, it is added to the SECOND deduction offered under Section 199A; one that is every bit as simple as the pass-through deduction is complex: a deduction for 20% of the taxpayer’s qualified REIT dividends and publicly traded partnership (PTP) income for the year.

These two deductions are truly separate and distinct. For example, if a taxpayer has a net loss from his or her flow-through businesses, it does not preclude the taxpayer’s ability to claim a deduction of 20% of REIT dividends and PTP income. Likewise, if a taxpayer’s sum of REIT dividends and PTP income is a loss, it does not reduce the taxpayer’s pass-through deduction.

After each separate deduction is computed, they are added together and then subjected to an OVERALL limitation, equal to 20% of the excess of:

- The taxpayer’s taxable income for the year (before considering the Section 199A deduction), over

- The sum of net capital gain (as defined in Section 1(h)). This includes qualified dividend income taxed at capital gains rates, as well as any unrecaptured Section 1250 gain taxed at 25% and any collectibles gain taxed at 28%.

As we’ll see later, the purpose of this overall limitation is to ensure that the 20% deduction is not taken against income that is taxed at preferential rates.

With the statutory construction settled, let’s take a look at the various nuances to Section 199A, and how those nuances are interpreted by the final regulations.

FINAL REGULATIONS

The best way to understand Section 199A is to take it step-by-step. I would recommend the following:

Step 1: Determine if each venture rises to the level of a Section 162 trade or business

Step 2: For each Section 162 trade or business, compute qualified business income (QBI).

Step 3: STOP!! Ask the all-important question: what is the business owner’s taxable income for the year. Because if it’s less than $157,500 ($315,000 for taxpayers married filing jointly), you don’t care about anything else. You don’t care about the type of business, the W-2 wages, the basis of property; none of it matters. All you need to do is take 20% of QBI, add 20% of qualified REIT dividends and PTP income, apply the overall limit based on taxable income, and call it a day. Do NOT make Section 199A more difficult than it is.

Step 4: However, if your business owner’s taxable income IS greater than $157,500 ($315,000 if married filing jointly), strap in. Now you’ve got your work cut out for you, and that work starts by moving on to the rest of the steps.

Step 5: Identify if any of the businesses are a specified service trade or business (SSTB) that is not eligible for the deduction.

Step 6: Once you’ve stripped out the SSTBs, decide whether you are eligible to — and want to — aggregate any of the remaining businesses. If you do aggregate, add the QBI, W-2 wages, and unadjusted basis immediately after acquisition (UBIA) of property together. If a pass-through entity you own an interest in has aggregated at the entity level, you have no choice but to stick with that aggregation, but you may be able to add one of your own businesses to the aggregation.

Step 7: If you don’t aggregate everything, you’ve got to apply the netting rules for any QBI loss.

Step 8: Once you’ve netted or aggregated everything, figure out the deduction by limiting 20% of QBI to the greater of:

- 50% of your share of W-2 wages paid by the business, or

- 25% of those same wages, plus 2.5% of your share of the UBIA of qualified property.

Step 9: Add 20% of qualified REIT dividends and PTP income.

Step 10: Apply the overall limit based on taxable income. Then have a stiff drink. You’re done.

I know that’s a lot, but remember, it’s only a lot if the business owner’s taxable income is over the threshold. So always remember to identify that early on in the process, so you don’t go charging into steps 5-8 when you don’t need to.

Now, let’s take on the steps one-by-one, and see what the final regulations have to say.

Step 1: The Section 162 Trade or Business Requirement

The final regulations establish a prerequisite whereby a business must first rise to the level of a “Section 162 trade or business” before it is capable of producing income eligible for the 20% deduction. Unfortunately, as the preamble to the regulations concedes, the statute has never defined what it means to be a Section 162 trade or business. As a result, taxpayers looking to satisfy this standard for various applications of the Code have been forced to turn to a near-century of case law.

In Groetzinger, the Supreme Court stated that to rise to the level of a Section 162 trade or business, “the taxpayer must be involved in the activity with continuity and regularity. . . . A sporadic activity, a hobby, or an amusement diversion does not qualify.”

As I’m wont to say, a Section 162 business is a lot like pornography — you may not be able to define it, but you tend to know it when you see it. For most active, profit-seeking enterprises, satisfying this requirement hasn’t been difficult. If you operate a dental practice, or a hardware store that’s open six days a week, you’ve got a Section 162 trade or business. Where the Section 162 standard has become and will remain problematic, however, is for rental real estate — or more accurately, as we’ll discuss later, for a specific type of rental real estate.

Rentals-as-a-Section-162-trade-or-business has gone largely unsettled because, well, generally…we don’t care. Rental expenses are allowable on page 1 of the tax return whether the rental is a trade or business (Section 62(a)(1)) or merely an investment (Section 62(a)(4)). As a result, there is limited case history governing whether rentals satisfy the trade or business standard.

Owing to this uncertainty, public comments on the proposed regulations shared a common theme: each begged for clarity on how to determine whether a rental rises to the level of a Section 162 trade or business. The IRS responded by publishing a proposed Revenue Procedure simultaneous with the final regulations that provides relief to some, but not all, rental activities.

In Revenue Procedure 2019-7, the IRS offered a safe harbor providing that a rental activity (or multiple rentals if the taxpayer chooses to treat them as a combined enterprise, with the understanding that commercial properties cannot be grouped with residential properties) will rise to the level of a Section 162 trade or business if:

- separate books and records are maintained for each rental activity (or the combined enterprise if grouped together),

- 250 hours or more of “rental services” are performed per year for the activity (or combined enterprise), and

- the taxpayer maintains contemporaneous records, including time reports or similar documents, regarding 1) hours of all services performed, 2) description of all services performed, 3) dates on which such services are performed, and 4) who performed the services.

For these purposes, rental services include advertising to rent, negotiating and executing leases, verifying tenant applications, collection of rent, daily operation and maintenance, management of the real estate, purchase of materials, and supervision of employees and independent contractors.

This safe harbor is great news for a number of rentals. But there are some activities that get shut out; first, a taxpayer can’t use the safe harbor for the rental of any residence that the taxpayer uses as a personal residence for more than 14 days during the year. So if you rent your beach house out for three weeks a year but live in it for four weeks, the safe harbor is unavailable to you.

More importantly, however, a taxpayer can’t use the safe harbor for any property rented on a triple net basis.

What is a triple net lease? It’s any lease where the landlord passes on the responsibility for paying real estate taxes, insurance, and maintenance to the tenant. And over the past century, while the courts have showed leniency in allowing even relatively hands-off rentals to be treated as a Section 162 trade or business, the judicial precedent is not on the side of property owners who rent via triple net leases. In those situations, because the building owner bears little of the responsibility of operating the building, the IRS has viewed the ownership of real estate rented on a triple-net basis as akin to holding stock, and it has treated the property as an investment rather than a Section 162 trade or business (See Neill and Rev. Rul. 73-522). Now, with those triple net landlords also shut out of the new safe harbor, the final regulations create a conundrum.

Consider the following:

Ex: A owns 20 large commercial properties through 20 separate limited liability companies. A also owns a management company that oversees all 20 properties, and he works full time seeking tenants, negotiating leases, and handling the various needs of the buildings’ occupants. Each building, however, is rented to its tenants on a triple net basis. The buildings generate $5 million in net rental income annually, and A spends over 2,000 hours each year managing his combined rental business.

Looked at logically, A is in the trade or business of owning and managing rental real estate. A’s activity is regular and continuous and clearly entered into for profit.

Section 199A and the final regulations, however, leave little room for logic on this issue. Rather, the regulations require the Section 162 trade or business standard to be met for each separate activity of the taxpayer. And although the regulations offer an elective aggregation regime, a business cannot be aggregated unless it first satisfies the Section 162 standard.

This creates a problem for A. When viewed globally, it is clear that managing 20 large commercial properties is a trade or business and would surely be treated as such if they were conducted through a single entity. Under Section 199A, however, A’s properties must be evaluated separately, and when they are, the triple net nature of each lease may preclude A from treating any of the rentals as a Section 162 trade or business, and in turn, any of the rental income as eligible for the Section 199A deduction.

Of course, the final regulations make clear that just because property rented on a triple net basis can’t use the safe harbor, it doesn’t necessarily prevent the taxpayer from arguing that the rental rises to the level of a Section 162 trade or business based on the facts and circumstances. But boy, the availability of that safe harbor would have been awfully nice.

Self-rentals

The final regulations do provide one exception to the trade or business requirement for rentals: A rental activity will be treated as a Section 162 trade or business if it is rented to a “commonly controlled” trade or business owned by the taxpayer. Thus, a “self-rental” is granted de facto Section 162 status, even if the activity might not have otherwise satisfied that standard.

To be “commonly controlled,” the property must be rented to an individual or pass-through (no C corporation), and the same owner — or group of owners — must own 50% or more of both the property and business. For these purposes, the 50% standard is measured by using the attribution rules of Sections 707 and 267, which is a departure from the proposed regulations.

1099 Filings

In the tax world, you can’t have your cake and eat it too. If you’re going to argue that your rental is a trade or business, you’ll have to treat it like a trade or business. This means filing Forms 1099 (I’ll bet you haven’t done that before), and accepting that any mortgage interest is now “business interest,” and is therefore subject to the new interest limitation rules of Section 163(j).

Step 2: Determine Qualified Business Income

In General

Once a taxpayer has established that he or she is engaged in a Section 162 trade or business, the taxpayer must determine the “qualified business income (QBI)” for each separate qualified trade or business.

QBI is defined as the net amount of qualified items of income, gain, deduction and loss with respect to a qualified trade or business that is effectively connected with the conduct of a business within the United States. I would encourage you to think of QBI as the normal, operating income the business was designed to generate. As a result, QBI does not include certain investment-related income, including the following:

- Any item of short-term capital gain, short-term capital loss, long-term capital gain, long-term capital loss, or any item treated as capital gain or loss. This last clause is important, because it means that a business owner’s net Section 1231 gain — which is generally taxed as capital gain under the chameleon rules of that section — will NOT be included in QBI. You get whipsawed, however, because if you have a net Section 1231 loss, the loss is treated as an ordinary deduction, and thus will reduce QBI.

- Dividend income, income equivalent to a dividend, or payment in lieu of a dividend described in Section 954(c)(1)(G);

- Any interest income other than interest income properly allocable to a trade or business;

- Net gain from foreign currency transactions and commodities transactions;

- Income from notional principal contracts;

- Any amount received from an annuity which is not received in connection with the trade or business, and

- Any deduction or loss properly allocable to the items described in the bullets above.

Reasonable Compensation and Guaranteed Payments

In addition, qualified business income does not include:

- Reasonable compensation paid to the shareholder of an S corporation, or

- Any guaranteed payments described in Section 707(c) paid to a partner for services rendered with respect to the trade or business, or any payment described in Section 707(a) to a partner for services rendered with respect to the trade or business. As a result, if you’ve got a partnership that pays out all of its income in guaranteed payments, you may want to switch to a model that instead specially allocates that income to the partners, as a special allocation of income is eligible for the 20% deduction, while the guaranteed payments are not.

As discussed in this article, the decision by Congress to exclude wages paid to a shareholder or guaranteed payments to a partner from qualified business income will place those taxpayers at a disadvantage relative to sole proprietors when taxable income is BELOW the thresholds at which the W-2 and property-based limitations apply.

Other Items and QBI

- Generally, a net operating loss carried into the current year does not factor into QBI at all. However, if a portion of the NOL is attributable to a loss denied under new Section 461(l) — which limits a taxpayer’s net business loss to $500,000 (if married, $250,000 for everyone else) — that portion of the NOL does reduce QBI in the succeeding year.

- When a taxpayer has a loss attributable to an activity suspended under either Sections 704 or 1366 (basis in a partnership and S corporation, respectively), Section 465 (at-risk limitation) or Section 469 (passive activity rules), the loss is carried forward to the next year. Under the regulations, when those losses are allowed in a future year, they must be taken into account to reduce QBI. However, any suspended losses from years prior to 2018 are NOT taken into account. The final regulations make clear that those losses — which previously have never been assigned a vintage — are used on a first-in/first-out basis. Interestingly, the Joint Committee of Taxation’s Blue Book disagrees with the final regulations, as it contains an example that reflects a passive loss suspended from 2017 reducing a taxpayer’s QBI in 2018.

- If a partner sells a partnership interest and some portion of the gain is recharacterized as ordinary income under the “hot asset” rules of Section 751, that gain is included in QBI.

- Deductions for items such as 1/2 of self-employment tax, self-employed health insurance, and certain retirement contributions reduce QBI to the extent the income from the business was taken into account to determine those deductions.

Step 3: STOP! Identify the Business Owner’s Taxable Income

I can’t stress this enough: if the business owner’s taxable income (before Section 199A) is less than $157,500 ($315,000 if married filing jointly), stop right there. You don’t care what type of business they are engaged in, and the aggregation rules, W-2 wages, and UBIA of property are irrelevant. The deduction is SIMPLE: it’s equal to 20% of QBI. Then, the deduction is subject to the overall limitation discussed in the introduction, equal to 20% of the excess of 1) taxable income, over 2) net capital gain (including qualified dividends).

Let’s take a look at a few examples:

Ex: A operates a computer repair shop as a sole proprietor. Income from the business is $100,000 in 2018. A also has $7,000 of long-term capital gain, and net taxable income of $74,000. A’s deduction is equal to the lesser of $20,000 (20% of QBI of $100,000) or $13,400 (20% of the excess of taxable income ($74,000) over net capital gain ($7,000)).

If a taxpayer has multiple activities, any positive and negative QBI is simply netted together before the deduction is computed.

Ex: A, a married taxpayer, operates two businesses. An S corporation allocates $100,000 to A, while an LLC allocates to A a loss of $40,000. A simply nets the loss against the income and deducts 20% of $60,000, or $12,000, subject to the overall limitation.

If a taxpayer has a NET loss, the loss is carried forward and will reduce QBI in the following year, even if the loss is used in the current year to reduce taxable income.

Ex: A, a married taxpayer, operates two businesses. An S corporation allocates $100,000 to A, while an LLC allocates to A a loss of $120,000. Because A has a net QBI loss of $20,000, A gets no deduction, and must carry the $20,000 loss to 2019, where it will reduce QBI.

See that? Ain’t so bad. But let’s see what happens if the taxpayer’s income is OVER the threshold…

Step 4: Income Over The Limit

If the business owner’s taxable income is greater than $157,500 ($315,000 in the case of married filing jointly), things become a nightmare. Above these income levels, we have to identify the type of business, deal with the aggregation and netting rules, and apply the W-2 and property-based limitations. Things actually reach MAXIMUM COMPLEXITY when taxable income is between $157,500 and $207,500 ($315,000 and $415,000 if married filing jointly), because during that delicate range, the deduction for a specified service trade or business is phased-OUT, while the W-2 and property-based limitations are phased-IN.

For guidance on what to do when the taxpayer’s taxable income is within the phase-out range and the business is NOT an SSTB, read this post.

For an example of how to determine the deduction attributable to a SSTB when a taxpayer has taxable income within the phase-out range, read this post.

Step 5: Identify Any Specified Service Trades or Businesses (SSTB)

A taxpayer must be engaged in a “qualified trade or business” in order to claim the Section 199A deduction.

Section 199A defines a qualified trade or business by exclusion; every trade or business is a qualified business other than:

- The trade or business of performing services as an employee, and

- A specified service trade or business.

The first prohibition prevents an employee from claiming a 20% deduction against his or her wage income.

Ex. A is an employee, but not an owner, in a qualified business. A receives a salary of $100,000 in 2018. A is not permitted to a Section 199A deduction against the wage income, because A is not engaged in a qualified business.

So an employee can’t get the 20% deduction, but an independent contractor can. As you might imagine, that distinction would motivate many to game the system by fleeing their role as an employee and re-upping with their former employer as an independent contractor. The final regulations, however, prevent such abuses by creating an important presumption –if a person WAS an employee of an employer, but suddenly becomes an independent contractor while providing substantially the same services directly or indirectly to the former employer, it is presumed for the NEXT THREE YEARS that they are STILL an employee for purposes of Section 199A, and thus ineligible for the Section 199A deduction.

The regulations contain an example that effectively puts an end to what was once considered a popular planning idea:

Ex. C is an attorney employed as an associate with Law Firm 1. C and the other associates in Law Firm 1 have taxable income below the threshold amount. Law Firm 1 terminates its employment relationship with C and its other associates. C and the other former associates form a new partnership, Law Firm 2, which contracts to perform services to Law Firm 1. C continues to provide substantially the same services to Law Firm 1 and its clients through Law Firm 2. The goal, obviously, was for C to convert wage income into pass-through income from Law Firm 2 that is eligible for the 20% deduction (even though Law Firm 2 is a SSTB, C is below the taxable income threshold).

Because C was formerly an employee of Law Firm 1 and continues to provide substantially the same services to Law Firm 1, C is presumed to be in the trade or business of being an employee of Law Firm 1. Unless the presumption is rebutted, C’s distributive share of income from Law Firm 2 will be treated as akin to wages, and will not be treated as qualified business income.

This presumption may be overcome if the employee-turned-independent contractor can show that under federal tax law, regulations, and principles (including common-law employee classification rules), the individual is performing services in a capacity other than an employee. It’s important to note, this recharacterization from independent contractor to employee is only for the purposes of Section 199A. It does not automatically convert the taxpayer to an employee for payroll tax purposes.

Specified Service Trades or Businesses

This second category of disqualified businesses serves the same purpose as the first, to prevent the conversion of personal service income into qualified business income. This latter category, however, takes aim at business owners, rather than employees, prohibiting the owner of a “specified service trade or business (SSTB)” from claiming a Section 199A deduction related to the business when income is above the aforementioned thresholds.

Section 199A(d)(2) defines a SSTB in reference to Section 1202(e)(3)(A), which includes among the businesses ineligible for the benefits of that section:

…any trade or business involving the performance of services in the fields of health, law, engineering, architecture, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, or any trade or business where the principal asset of such trade or business is the reputation or skill of one or more of its employees.

Section 199A modifies this definition in two ways: first, by removing engineering and architecture from the list of prohibited specified services businesses, before then amending the final sentence to reference the reputation or skill of one or more of its “employees or owners” rather than merely its “employees.”

Section 199A(d)(2)(B) then adds to the list of specified service businesses any business which involves the performance of services that consist of investing and investing management, trading, or dealing in securities, partnership interests, or commodities.

The final regulations provide much needed clarity on the definition of an SSTB. Of course, the authors couldn’t possibly anticipate every alternative, so there will surely be fact patterns that continue to create confusion. But here’s what was addressed:

Definitions of Specific Disqualified Fields

The regulations attempt to leverage off existing regulations under Section 448 and provide further interpretation of the disqualified fields. Let’s see who’s disqualified and who isn’t in each field:

- Health

- Disqualified: doctors, pharmacists, nurses, dentists, veterinarians, physical therapists, psychologists, and other “similar healthcare professionals.” It is important to note, in the proposed regulations, the language included “other similar healthcare professionals who provide medical services directly to a patient.” The final regulations removed the italicized section, which likely broadens the scope of the field of health. For example, removal of that language means that someone like a radiologist or technician, who may not meet directly with a patient and thus perhaps previously had an argument that they were NOT in the field of health, will now fit squarely within its definition.

- In addition, the final regulations responded to a string of public comments by providing examples reflecting that with the right facts, an assisted living facility and a surgery center may NOT be in the field of health.

- Not disqualified: people who provide services that may improve the health of the recipient, such as the operator of a health club or spa, or the research, testing, and sale of pharmaceuticals or medical devices.

- Law

- Disqualified: Lawyers, paralegals, legal arbitrators, and mediators.

- Not disqualified: Those that provide services not unique to law, like printing, stenography, or delivery services.

- Accounting

- Disqualified: Accountants, enrolled agents, return preparers, financial auditors, bookkeepers, and similar. You don’t need to be a licensed CPA to fall victim to this rule.

- Not disqualified: No one. We’re all screwed.

- Actuarial Science:

- Disqualified: actuaries and similar professionals.

- Analysts, economists, mathematicians, and statisticians not engaged in analyzing or assessing the financial costs of risk or uncertainty of events.

- Performing Arts:

- Disqualified: Actors, singers, musicians, entertainers, directors, and similar professionals who provide services that lead to the creation of performing arts. The final regulations also clarified that if you write a song or screenplay that will be integral to the creation of a performing art, you fall victim to this designation as well.

- Not disqualified: Those who broadcast or disseminate video or audio to the public, and those who maintain or operate equipment or facilities used in the performing arts. An author of a work that is not turned into performing art should be fine.

- Consulting:

- Disqualified: those who provide professional advice and counsel to clients to assist in achieving goals and solving problems, including government lobbyists.

- Not disqualified: Salespeople and those who provide training or educational courses. This category also does not include any services ancillary to the sale of goods in a business that is NOT a SSTB (such as a building contractor) as long as there is no separate fee for the consulting services.

- A THOUGHT: consulting sounds awfully broad. After all, don’t most businesses provide “advice and counsel?” From my perspective, the best way to conceptualize who is (and isn’t) a consultant is to leverage off of the personal service corporation regulations at Reg. Sec. 1.448-1T. Under those regulations, you are a consultant if you are paid ONLY for providing advice and counsel. To the contrary, if you get paid only upon the “consummation of the transaction your services were intended to affect,” you are NOT a consultant. What does that mean? Look at it this way: say you’re a firm that comes into a workplace, identifies their staffing needs, and then tells the employer how many people they should hire and in what capacity. That’s all you do; the employer has to fill its staffing needs elsewhere. You collect your cash, and you’re on your way. In this situation, you are a consultant; all you did was provide advice, and you got paid. Conversely, if you go into that same workplace and recommend staffing need and then provide the staffing, you are NOT a consultant, because you didn’t get paid purely for providing advice and counsel, but rather only when you provided employees for the workforce. In other words, you got paid only “upon consummation of the transaction your services were intended to affect. See the difference?

- Athletics:

- Disqualified: athletes, coaches, team managers, team owners.

- Not disqualified: Broadcasters or those who maintain or operate equipment used in an athletic event.

- Financial Services:

- Disqualified: Those who provide financial services to clients including managing wealth, developing retirement or transition plans, M&A advisory, valuation work. In other words, financial advisors, investment bankers, wealth planners, and retirement advisors.

- Not disqualified: Banking!

- Brokerage Services

- Disqualified: A broker who arranges transactions between a buyer and a seller with respect to securities; i.e., a stock broker.

- Not disqualified: Owing to the italics above, a real estate broker is OK, as is an insurance broker.

- Investment Management

- Disqualified: Those who receive fees for providing investing, asset management, or investment management services.

- Not disqualified: real estate management.

- Trading:

- Disqualified: those who trade in securities, commodities or partnership interests.

- Not disqualified: A farmer or manufacturer who engages in hedging transactions as part of their trade or business.

Application of the ‘Catch-All”

The most concerning aspect of the Code’s definition of an SSTB is the catch-all that includes “any trade or business where the principal asset of such trade or business is the reputation or skill of one or more of its owners or employees.”

The most obvious problem posed by the catch-all is that it threatened any taxpayer who was not engaged in one of the businesses that is specifically listed as a disqualified field. Consider the case of a “personal trainer to the stars:” using the definition of an SSTB found in the final regulations, it is clear that a personal trainer is not in the field of health or athletics.

Application of the catch-all, however, if interpreted broadly, would likely yield a different result. What is the principal asset of a celebrity personal trainer if not the reputation and expertise of that trainer?

Fortunately, the IRS chose to define the catch-all VERY narrowly. Only the following trades or businesses will fall victim to the catch all because their principal assets will be treated as the skill or reputation of its employees:

- A trade or business in which a person receives fees, compensation, or other income for endorsing products or services,

- A trade or business in which a person licenses or receives fees, compensation, or other income for the use of an individual’s image, likeness, name, signature, voice, trademark, or any other symbols associated with the individual’s identity, or

- Receiving fees, compensation, or other income for appearing at an event or on radio, television, or another media format.

The regulations provide a couple of illustrative examples, including this one:

Ex. H is a well known chef and the sole owner of multiple restaurants, each of which is owned in a disregarded entity. Due to H’s skill and reputation as a chef, H receives an endorsement fee of $500,000 for the use of H’s name on a line of cooking utensils and cookware. H is in the trade or business of being a chef and owning restaurants and such trades or businesses are NOT SSTBs. However, H is also in the trade or business of receiving endorsement income. H’s trade or business consisting of the receipt of the endorsement fee for H’s skill and/or reputation is an SSTB.

A question remains, however: what if a business collects endorsement income, but the person whose fame generated the income is no longer alive? For example, what if a famous golfer licenses his name to a brand of clubs, and after he passes away, his heirs inherit the company that continues to generate the endorsement income. Is that income ineligible for the Section 199A deduction even though the business owners were not the ones who endorsed the product?

De Minimis Rule

As discussed earlier, section 199A defines an SSTB to include any trade or business that “involves the performance of services” in a disqualified field. Before the regulations were published, that language led many to believe that even a small amount of prohibited services would taint an entire business. For example, if a business that sold software also charged customers a fee for installation or implementation, because the business involved the performance of services in the field of consulting, fears were that the entire business — including the software sales — would be treated as an SSTB.

Reg. Section 1.199A-5(c)(1) prevents that result, providing a de minimis exception to SSTB classification. For a business with gross receipts of less than $25 million, if 10% or less of the gross receipts are attributable to the performance of services in a disqualified field, the service income is ignored and the entire business is not an SSTB.

Ex: S Co. earns $20 million in gross receipts in 2018 from software sales. S Co. also earns $2 million from consulting revenue related to the installation and implementation of the software. Although the consulting revenue would generally be considered SSTB-type income, because the consulting receipts are less than 10% of the total combined revenue, the consulting activity is treated as de minimis, and the entire business is treated as a non-SSTB.

A similar rule exists for a business with gross receipts exceeding $25 million; in that situation, however, the SSTB receipts must be less than 5% of the business’s total receipts.

Although the de minimis rules offer welcome relief to a business with both service and non-service income, the presence of the test raised a question that the proposed regulations neglected to answer: Is the de minimis rule a cliff? In other words, if the SSTB income of a business is more than de minimis, is the entire business tainted, or is the SSTB income treated as being earned in a separate trade or business, leaving the income from the non-SSTB business unsullied for purposes of Section 199A?

To illustrate, what would be the result if the consulting revenue in the previous example were $4 million rather than $2 million, so that it exceeded 10% of the total revenue of $24 million? Would only the $4 million be treated as SSTB income, or the entire $24 million?

Support could be found in the proposed regulations for either result. In the preamble, the IRS explained that the de minimis exception “is necessary to avoid very small amounts of SSTB activity within a trade or business making the entire trade or business ineligible for the deduction” and that “an alternative to the de minimis exception would be to require businesses or their owners to trigger the SSTB exclusion regardless of the share of gross income from specified service activities.” When read in the opposite, these statements would indicate that in the absence of a de minimis exception, even a small amount of SSTB income would taint an entire business. As a result, in the hypothetical posed earlier, the full $24 million in gross receipts from the software consulting business would be SSTB income.

This result, however, runs contrary to the repeated contentions made within the preamble and the regulations themselves that one entity may contain multiple trades or businesses for the purposes of Section 199A. For example, as part of the reporting requirements for passthrough entities imposed by the regulations, each entity must disclose “whether any of its businesses are SSTBs” (emphasis added).

This language would strongly support the contention that if a taxpayer has SSTB activity that generates more than a de minimis amount of income, that activity may well rise to the level of its own trade or business. Should that occur, in the hypothetical provided earlier, only the $4 million of consulting revenue would be considered SSTB income, with the $20 million of software sales revenue preserved as non-SSTB income eligible for the section 199A deduction.

The final regulations provide some clarity by offering two examples that show the result if a taxpayer’s SSTB revenue is more than de minimis. The first example shows when things go wrong…

Ex: Landscape LLC sells lawn care and landscaping equipment and also provides advice and counsel on landscape design for large office parks and residential buildings. The landscape design services include advice on the selection and placement of trees, shrubs, and flowers and are considered to be the performance of services in the field of consulting. Landscape LLC separately invoices for its landscape design services and does not sell the trees, shrubs, or flowers it recommends for use in the landscape design. Landscape LLC maintains one set of books and records and treats the equipment sales and design services as a single trade or business for purposes of Sections 162 and 199A. Landscape LLC has gross receipts of $2 million. $250,000 of the gross receipts is attributable to the landscape design services, an SSTB. Because the gross receipts from the consulting services exceed 10% of Landscape LLC’s total gross receipts, the entirety of Landscape LLC’s trade or business is considered an SSTB.

…while the second example shows when things go right.

Ex. Animal Care LLC provides veterinarian services performed by licensed staff and also develops and sells its own line of organic dog food at its veterinarian clinic and online. The veterinarian services are considered to be the performance of services in the field of health. Animal Care LLC separately invoices for its veterinarian services and the sale of its organic dog food. Animal Care LLC maintains separate books and records for its veterinarian clinic and its development and sale of its dog food. Animal Care LLC also has separate employees who are unaffiliated with the veterinary clinic and who only work on the formulation, marketing, sales, and distribution of the organic dog food products. Animal Care LLC treats its veterinary practice and the dog food development and sales as separate trades or businesses for purposes of Section 162 and 199A. Animal Care LLC has gross receipts of $3,000,000. $1,000,000 of the gross receipts is attributable to the veterinary services, an SSTB. Although the gross receipts from the services in the field of health exceed 10% of Animal Care LLC’s total gross receipts, the dog food development and sales business is not considered an SSTB due to the fact that the veterinary practice and the dog food development and sales are separate trades or businesses under Section 162.

As you can see, two key factors leading to the favorable result in the second example are 1) the taxpayer keeps separate books and records for each business line, and 2) each business line has separate employees. This second factor is critical because in the preamble to the final regulations, the IRS goes to great pains to make clear that simply keeping separate books and records is not enough to show that you are conducting multiple trades or businesses; rather, the determination is based on all the facts and circumstances. We don’t know exactly what that means, of course, but one thing we DO know is this: if you’re NOT keeping separate books and records for your SSTB and non-SSTB lines, you’ve got no chance of arguing that they are separate trades or businesses, and if the SSTB revenue becomes more than de minimis, the entire business is tainted.

Services or Property Provided to a Specified Service Trade or Business

The moment the statute was finalized, tax lawyers and CPAs scrambled to find ways to strip income OUT of a specified service business and into a business that was eligible for the 20% deduction. The first of these strategies was coined “cracking,” and involved removing a qualified business from an SSTB and having it charge a fee to the SSTB; for example, the owners of a law firm would purchase a building in a separate LLC and rent the building to the law firm. This would reduce the income in the law firm — which isn’t eligible for a 20% deduction anyway — and move it to a rental activity, where — the thought was — it would be treated as qualified business income.

The final regulations put a big damper on cracking, however, by providing that if a business rents property or provides services to a commonly controlled SSTB, the rental income or service income generated from the SSTB is treated as SSTB income as well. Once again, “common control” is achieved when a person or group of people own 50% or more of both businesses, after applying the attribution rules of Sections 267 and 707.

Ex. A and B own law firm AB. A and B purchase a building in AB LLC, and rents 70% of the building to the law firm. The building is the only asset the LLC owns. Even though the rental of real property is generally not treated as an SSTB, because the building is rented to a commonly-controlled SSTB (the law firm), 70% of the rental income is treated as being earned in an SSTB, and is not eligible for the 20% deduction.

It is worth noting that in the proposed regulations, if a business rented more than 80% of its property or provided more than 80% of its services to a commonly-controlled SSTB, ALL of the income was converted into SSTB income, even if some of the income was generated from unrelated parties. The final regulations found that provision to be unduly harsh, and removed the 80% standard.

De minimis Non-SSTB Revenue

The proposed regulations provided a rule whereby if an SSTB — think: an eye doctor — had a separate business that generated non-SSTB revenue — think: selling glasses — and 1) the business were commonly controlled, 2) they shared expenses, and 3) the non-SSTB revenue was less than 5% of the total revenue of the two businesses, the non-SSTB nature of the business was ignored and treated as SSTB revenue. It effectively acted as the opposite of the regular de minimis rule discussed above. The final regulations, however, did away with this rule.

Step 6: Aggregation of Commonly Controlled Businesses

Once any SSTBs are stripped out of the discussion, we’re left with only qualifying businesses. The statute had required that the deduction then be determined separately for each business. This was going to send a lot of taxpayers scrambling in order to make sure the mix of qualified QBI, W-2 wages and property basis were such that it would maximize each, separate deduction.

The regulations, however, give us an elective aggregation regime. Aggregation under Section 199A can only be done when the following requirements are met:

- Each business to be aggregated rises to the level of a Section 162 trade or business.

- The same person or group of persons, directly or indirectly, own 50% or more of each business to be aggregated. For S corporations, the ownership is measured by reference to the outstanding stock; for partnerships, it is measured by reference to the interest in capital or profits in the partnership. The attribution rules of Sections 267 and 707 apply for these purposes (this was NOT the case under the proposed regulations). In addition, the final regulations make clear that to be considered part of a “group” of owners, the same people do not need to own an interest in EACH entity being considered for aggregation.

- The “control test” is met for the “majority” of the tax year, which MUST INCLUDE THE LAST DAY OF THE TAX YEAR.

- The businesses share the same tax year.

- None of the businesses may be SSTBs.

- The businesses to be aggregated must satisfy two of the following three factors:

- They must provide products, services, or property that are the same or customarily offered together;

- They must share facilities or significant centralized business elements, such as personnel, accounting, legal, manufacturing, purchasing, human resources, or information technology resources; or

- The businesses are operated in coordination with, or reliance upon, one or more of the businesses in the aggregated group.

If you elect to aggregate, you determine your share of QBI, W-2 wages, and UBIA for the aggregated businesses before computing the deduction.

Ex. A, B, C, and D each own 25% of two businesses, a restaurant and a catering business. The businesses share a kitchen, centralized purchasing to obtain volume discounts and a centralized accounting office that performs all of the bookkeeping, tracks and issues statements on all of the receivables, and prepares the payroll for each business. Even though none of A, B, C or D own 50% directly, because the same group of taxpayers control 50% or more of both businesses, ANY OF A, B, C and D may aggregate the businesses if the other tests are met. Bit before any can aggregate, the two businesses must satisfy two of the three factors. They do, as they both offer prepared food to customers, an they share facilities and centralized business elements. As a result, any of A, B, C, or D can elect to aggregate some or all of the business together. They may all choose different groupings.

This is not an “all or nothing” election. Rather, a taxpayer may elect to group some activities while leaving others alone. As a result, this aggregation regime more closely resembles the “slice and dice” grouping rules of Section 1.469-4, as opposed to the “all or nothing” grouping regime for real estate professionals under Reg. Section 1.469-9(g).

Ex. E owns a 60% interest in the capital and profits of each of four partnerships (PRS1, PRS2, PRS3, and PRS4). Each partnership operates a hardware store. A team of executives oversees the operations of all four of the businesses and controls the policy decisions involving the businesses as a whole. Human resources and accounting are centralized for the four businesses. E elects to aggregate PRS1, PRS3, and PRS4 for purposes of Section 199A, and leaves PRS2 alone. PRS2 is the only business that generates a loss.

Because E owns more than 50% of the capital of each of the four partnerships, and because the partnerships 1. sell the same product, and 2. have centralized management, they are eligible to be grouped together. Thus, A aggregates the QBI, W-2 wages, and property basis of PRS1, PRS3 and PRS4 together before reducing the QBI (with no impact on the W-2 wages, see discussion later in this article on netting of losses) for the loss generated by PRS2.

The electing owner does not have to own more than 50% of each business directly; rather, he or she must simply establish that SOMEONE owns 50% or more of all of the entities the owner wishes to aggregate.

Ex. F owns a 75% interest in five partnerships. G owns a 5% interest in each of the five partnerships. H owns a 10% interest in only two of the partnerships. Each partner is a restaurant and shares centralized function and management. F may elect to aggregate all five partnerships. So may G, even though G owns only a 5% interest in each partnership, because G can show that F owned 50% or more of each of the partnerships, thus they are “commonly controlled.” H may only aggregate the two partnerships in which H owns an interest.

As we discussed earlier, through a special rule in the regulations, a self-rental activity will be treated as a Section 162 trade or business, and thus can be aggregated with the business.

Ex. G owns 80% of the stock of S1, an S corporation that leases property to LLC1 and LLC2. The two LLCs manufacture and sell widgets. G also owns 80% of LLC1 and LLC2. While S1, as the owner of a rental property, generally might not be considered to rise to the level of a Section 162 trade or business, under the final regulations, because S1 leases to a commonly controlled business, S1 is treated as a trade or business and may be aggregated with LLC1 and LLC2.

IMPORTANT: under the proposed regulations, aggregation could be done only at the owner level. The final regulations reverse course on this point, however, by allowing a pass-through entity to aggregate its own activities. If a pass-through entity elects to aggregate, the owners of that business are bound by that aggregation. They can, however, add to that aggregation with their own activities if all conditions are met.

Ex. PRS1, a partnership, directly operates a food service trade or business and owns 60% of PRS2, which directly operates a movie theater trade or business and a food service trade or business. PRS2’s movie theater and food service businesses operate in coordination with, or reliance upon, one another and share a centralized human resources department, payroll, and accounting department. PRS1’s and PRS2’s food service businesses provide products and services that are the same and share centralized purchasing and shipping to obtain volume discounts. PRS2 may aggregate its movie theater and food service businesses. The factors are satisfied because the businesses operate in coordination with one another and share centralized business elements. If PRS2 does aggregate the two businesses, PRS1 may not aggregate its food service business with PRS2’s aggregated trades or businesses, because it doesn’t satisfy the two factors with PRS2’s movie theater business.

If PRS2 doesn’t aggregate, however, because PRS1 owns more than 50% of PRS2, PRS1 may aggregate its food service businesses with PRS2’s food service business, because the businesses provide the same products and services and share centralized business elements. Even if PRS2 doesn’t aggregate, PRS1’s food service business and PRS2’s movie theater cannot be aggregated because there are no shared factors.

Aggregation under Reg. Section 1.199A-4 is purely elective, and generally cannot be revoked once an election is made. If a new business comes into the fold, however, the taxpayer may add the new business to any previously aggregated businesses provided all of the requirements are met. If at any point, previously aggregated businesses no longer meet the requirements for aggregation, the aggregation will cease to exist. For EACH year, individuals and electing pass-through entities must attach a statement to their returns identifying each aggregated business, and include additional information as required by the regulations. Failure to disclose the aggregation may result in the IRS disallowing the grouping.

Making the aggregation election was going to add significant stress to the 2018 tax filing season, because tax advisors would be pressed to determine the ideal aggregation while being faced with the knowledge that an inefficient election would have long-term effects. The final regulations alleviate this burden in two ways: first, if you don’t elect to aggregate in 2018, that doesn’t mean you’ve missed your chance. You can always elect to aggregate for the first time in a future year. More importantly, however, for 2018 ONLY, you can elect to aggregate on an amended return.

Also note, aggregation is not always a no-brainer. There will be times, though admittedly rare, where it behooves you NOT to aggregate. The point is: do the math.

Step 7: Netting of Income and Losses

If you don’t (or can’t) aggregate everything together, you’ve got to net loss from one business against any activities with positive QBI. Under the final regulations, if the net amount of all positive and negative QBI is a loss, as was provided in the statute, no deduction is allowable in the current year and the net loss is carried forward to the next year. The regulations make clear, however, that no W-2 or basis amounts carry forward.

If the net of all positive and negative QBI is positive, however, but at least one business produces a loss, the loss must be allocated among all of the businesses that produce QBI in proportion to their respective amounts of QBI. Only after this allocation and netting takes place are the W-2 and basis limitations applied, and no part of the W-2 amounts or basis of property attributable to the loss business are taken into account by the income-producing businesses.

By forcing a taxpayer to allocate a loss proportionately among multiple businesses that generate QBI, it prevents potential abuse.

In 2018, A, a married taxpayer, is allocated $100,000 of qualified business income from business 1 that pays $50,000 of W-2 wages. A is also allocated $100,000 of QBI from business 2 that has $0 in W-2 wages. Finally, A is allocated a $100,000 loss from business 3 that pays $70,000 in W-2 wages. Barring a rule to the contrary, A could try to net the $100,000 loss from business 3 with the $100,000 of income from business 2, because A knows he would not get a deduction attributable to business 2 in any case, because business 2 has paid no wages.

To prevent this result, the final regulations require the $100,000 loss from business 3 to be allocated to business 1 and business 2 in proportion to their QBI. Thus, each business is allocated a $50,000 loss. Business 1 has a net QBI of $50,000, and a deduction equal to the lesser of $10,000 (20% of $50,000) or $50,000 (50% of W-2 wages of $100,000). Business 2 has net QBI of $50,000 as well, but no deduction because business 2 paid no W-2 wages. A’s total deduction is $10,000.

Of course, under the final regulations, as discussed above, a taxpayer may elect to group qualifying businesses together. If this is done, the QBI income and loss, W-2 wages, and UBIA are all combined; this will often prove advantageous, particularly when the loss company has W-2 wages.

Ex. Continuing the example above, if A is eligible to and elects to aggregate businesses 1, 2 and 3, A will simply compute one Section 199A deduction, using the following combined amounts: $100,000 of QBI and $120,000 of W-2 wages. A’s deduction is the lesser of $20,000 or $60,000, or $20,000. Thus, by aggregating, A has increased his Section 199A deduction by $10,000.

Step 8: Determining the W-2 and Property Based Limitations

As a reminder, when the business owner’s taxable income exceeds $157,500 ($315,000 if married filing jointly), the deduction for each business — or combined businesses, if properly aggregated — is limited to the greater of:

- 50% of the taxpayer’s share of the W-2 wages paid by the business, or

- 25% of those same wages, plus 2.5% of the taxpayer’s share of the unadjusted basis immediately after acquisition (UBIA) of qualified property.

Let’s start unpacking these key terms.

W-2 Wages

“W-2 wages” are the total wages (as defined in Section 3401(a)) subject to wage withholding, elective deferrals, and deferred compensation paid by the qualified trade or business with respect to its employees during the calendar year ending during the tax year of the taxpayer. In August, the IRS published Notice 2018-64, which provides three methods for computing W-2 wages. Yesterday, the IRS offered additional guidance in the form of Rev. Proc. 2019-11.

The most important aspect of the final regulations is the flexibility afforded to taxpayers to allocate W-2 wages paid by another party to a business as long as those wages were paid on behalf of common-law employees of the business receiving the allocation. Of course, in this case, the business who actually paid and reported the W-2 wages that are being allocated to the common law employer must reduce its W-2 wages for purposes of Section 199A by that amount.

While allocating W-2 wages among businesses won’t be necessary if aggregation is available, in some cases, aggregation is not an option; for example, if a business uses a professional employer organization (PEOs) to pay its employees. By allowing for an allocation, a taxpayer who uses leased employees may allocate a portion of the PEO’s W-2 wages to the taxpayer.

Once W-2 wages are determined for each business, they must be allocated and disclosed to the partners or shareholders. Partners are allocated W-2 wages in accordance with the manner in which ordinary business income or loss of the partnership is allocated. Shareholders receive a straight per-share/per-day pro rata allocation.

W-2 wages do NOT include guaranteed payments made to a partner. As a result, if a partnership has high-income partners and no outside employees (and thus no W-2 limit), the partnership may want to consider checking the box to be treated as a corporation and then making an S election. This would force the partners to convert their guaranteed payments into W-2 wages, giving rise to a limitation.

UBIA of Qualified Property

The version of Section 199A that initially passed the Senate contained only the “50% of W-2 wages” limitation. During the subsequent conference committee meetings, however, an alternate limitation was added: 25% of W-2 wages plus 2.5% of the unadjusted basis of “qualified property.”

The unstated motivation behind this late addition to the statute was to permit owners of rental property to qualify for the benefits of Section 199A. It is common that an entity that houses rental property – typically, a partnership – will not pay W-2 wages; rather, it will pay a management fee to a management company. Because a management fee is not considered W-2 wages for the purposes of Section 199A, without this last-minute change, many large landlords would have been shut out from claiming the deduction.

Ex. A owns a commercial rental property through an LLC. His share of the rental income earned by the LLC is $800,000. The LLC pays no W-2 wages, but A’s share of the unadjusted basis of the building is $10,000,000. In the absence of the alternate limitation, A would be entitled to no deduction because the “50% of W-2 wages” limitation would be zero. Under the final version of Section 199A however, A is entitled to a deduction of $160,000, the lesser of 20% of qualified business income or the greater of:

- 50% of W-2 wages, or $0, or

- 25% of W-2 wages plus 2.5% of $10,000,000, or $250,000.

Only the UBIA of “qualified property” is counted towards the limitation. Qualified property is tangible property (so no intangibles) subject to depreciation; as a result, the basis of raw land and inventory, for example, would not be taken into account. The business must own the property on the last day of the tax year, and the OWNER must own an interest in the business on the last day of the BUSINESS’ tax year as well. So if a partner or shareholder sells his interest mid-way through the year, he or she doesn’t get to count any of the UBIA of the partnership or S corporation towards the 2.5% limit.

UBIA is determined on the date the property is placed in service, and is generally the same basis that is determined under general tax principles. So if a taxpayer buys a building for $10 million, the UBIA on the placed-in-service date is $10 million as determined under Section 1012.

There are exceptions, however. The final regulations provide that in the case of a Section 1031 exchange, a Section 1033 involuntary conversion, or a Section 168(i)(7) carryover exchange, the transferee taxpayer takes a UBIA equal to the transferor’s UBIA, regardless of what general tax principles have to say.

Ex. A acquired machinery in 2016 for $10,000 for use in a sole proprietorship. As of 12.31.2018, the adjusted basis of the machinery, after accounting for depreciation, is $4,000. On 1.1.2019, A contributes the property to an S corporation in a Section 351 transfer in exchange for stock in the S corporation. Under the proposed regulations, on S Co.’s 2019 tax return, the UBIA of the machinery would have been only $4,000, the basis S Co. takes in that machinery under general tax principles (Section 362). Under the final regulations, however, the corporation gets to take a UBIA in the transferred property equal to A’s UBIA of the property, or $10,000.

While this rule change yields a higher UBIA for the S corporation in this example, the trade-off is additional complexity. The S corporation will now have one basis for tax purposes ($4,000) and another for UBIA purposes ($10,000).

Once the UBIA of property is determined, it is NOT reduced by any subsequent depreciation, whether ordinary depreciation, bonus depreciation, or Section 179 depreciation.

You can only count the UBIA of property towards the 2.5% limitation for a year if the “depreciable period” of the property has not ended before the close of the tax year. The depreciable period generally begins on the date the property is placed in service and ends on the later of:

- 10 years after the date placed in service, or

- The last day of the last full year in the applicable recovery period that would apply to the property under Section 168 (ignoring the alternative depreciation system).

Again, there are quirks. If you acquire property in a Section 1031 exchange, Section 1033 conversion, or tax-free transfer, the depreciable period tacks to the period you held the relinquished property (in the case of Sections 1031 or 1033) or the period the transferor held the property (in the case of a tax-free transfer).

Ex: same facts as in the previous example. When A transfers the property to the S corporation in 2019, the depreciable period of the property does not start for S Co. in 2019. Rather, because the property was received from A in a tax-free Section 168(i)(7) transfer, the depreciable period tacks to A’s holding period, meaning it begins in 2016, rather than 2019.

The final regulations make a change to the proposed regulations and provide that we now get to include a Section 743 step-up pursuant to a Section 754 election in our UBIA of property, but only to the extent the step-up exceeds what it would have been if it were made in relation to the original UBIA, rather than the tax basis, of the property. I know that sounds confusing, but it’s not that bad. Check it out…

Ex. A, B, and C put in $300,000 each to a partnership and the partnership buys a building with a UBIA of $900,000. Then, at a time when the building is worth $1,200,000 and the basis of the property is only $600,000, A sells his interest to D for $400,000. D has a $200,000 Section 743 adjustment ($400,000 sales price less A’s $200,000 share of basis). This $200,000 adjustment DOES increase D’s UBIA of property, but only to the extent that the step-up exceeds the adjustment that would have occurred if the purchase price ($400,000) were compared to A’s original UBIA of the property ($300,000), or $100,000. Thus, the UBIA to D related to the step-up is only $100,000 ($200,000 – $100,000).

Interestingly, UBIA is not created when property basis is stepped-up upon a redemption of a partnership interest under Section 734.

UBIA, like W-2 wages, must be allocated among partners and shareholders. For partners, the final regulations depart from the proposed regulations and provide that the UBIA of each property is allocated among the partners in the same manner in which the BOOK DEPRECIATION generated by the asset is allocated. As of now, there is no guidance on how to allocate the UBIA of property if it has been fully depreciated for book purposes. Shareholders in an S corporation will receive an allocation of UBIA based on the percentage of shares the shareholder owns on the last day of the S corporation’s tax year.

Step 9: Add 20% of REIT Dividends and PTP Income

Not much to say here. The big thing to remember is that a net QBI loss does not reduce this deduction, nor does a net PTP loss reduce the QBI deduction.

Step 10: Putting it all Together

Let’s run through some examples that show how this all works when a business owner is above the threshold.

If multiple businesses and no aggregation, determine the deduction for each business separately.

Ex. F, a single taxpayer, owns 100% of X, Y, and Z. None have UBIA, but each have QBI and wages as follows:

- X – QBI of $1,000,000; W-2 wages of $500,000

- Y- QBI of $1,000,000; no W-2 wages

- Z-QBI of $2,000; W-2 wages of $500,000.

- F’s taxable income is $2,722,000.

F determines the deduction for each business separately:

- X: $200,000 limited to $250,000, or $200,000.

- Y: $200,000 limited to $0, or $0

- Z: $400 limited to $250,000, or $400.

Thus, the total deduction is $200,400, limited to 20% of $2,722,000, or $544,000. Final deduction is $200,400.

This deduction, however, is woefully inefficient. Why? Because Y has QBI but no W-2 wages, and Z has a small amount of QBI but large W-2 wages. In this situation, aggregation would be ideal if it’s available. Let’s see why:

Ex. F, a single taxpayer, owns 100% of X, Y, and Z. None have UBIA, but each have QBI and wages as follows:

- X – QBI of $1,000,000; W-2 wages of $500,000

- Y- QBI of $1,000,000; no W-2 wages

- Z-QBI of $2,000; W-2 wages of $500,000.

- F’s taxable income is $2,722,000.

F elects to aggregate all three businesses. F determines the deduction for the aggregated business as follows: Total QBI is $2,002,000 * 20% = $400,400. 50% of total W-2 wages is $500,000. Thus, the total deduction is $400,400, limited to 20% of taxable income, or $544,400, or $400,400. Thus, F increased his deduction from $200,400 to $400,400 by aggregating.

Aggregation, however, is not always ideal. Consider this:

Ex. F, a single taxpayer, owns 100% of X and Y.

- X- QBI of $1,000,000; $400,000 of W-2 wages.

- Z-QBI of $1,000,000, UBIA of $4,000,000.

F elects to aggregate both businesses. F determines the deduction for the aggregated business as follows. Total QBI is $2,000,000 * 20% = $400,000, limited to the greater of:

- 50% of total W-2 wages of $200,000, or

- 25% of total W-2 wages ($100,000) + 2.5% of UBIA ($100,000), or $200,000.

Thus, the total deduction is $200,000.

Not bad…but look what happens if we DON’T aggregate:

Ex. F, a single taxpayer, owns 100% of X and Y.

- X- QBI of $1,000,000; $400,000 of W-2 wages.

- Z-QBI of $1,000,000, UBIA of $4,000,000.

F does not elect to aggregate both businesses. F determines the deduction for each separate business:

- X- $200,000 limited to 50% of W-2 wages, or $200,000.

- Y – $200,000 limited to 2.5% of UBIA, or $100,000.

Thus, the total deduction is $300,000. The deduction has increased by $100,000 by NOT aggregating because one business uses the W-2 limit, the other uses the UBIA limit, and if you aggregate them, the limits don’t increase.

Remember, if you don’t aggregate, you must net a QBI loss against any positive QBI in proportion to the positive QBI.

Ex. F, a single taxpayer, owns 100% of X, Y, and Z. None have UBIA, but each have QBI and wages as follows:

- X – QBI of $1,000,000; W-2 wages of $500,000

- Y- QBI of $1,000,000; no W-2 wages

- Z-QBI of ($600,000) W-2 wages of $500,000.

F has taxable income in excess of the threshold and does not elect to aggregate all three businesses. F must first allocate the loss from Z to X and Y based on respective QBI. Because the positive QBI is equal, each business is allocated a $300,000 loss. The wages are not allocated.

- Thus, X’s QBI becomes $700,000. Deduction is $140,000 limited to $250,000, or $140,000.

- Y’s QBI is also reduced to $700,000. Deduction is $140,000 limited to $0, or $0.

Thus, the total deduction is $140,000.

In the previous example, the result is painful because while the loss from Z is absorbed by X and Y, X and Y get no benefit from Z’s W-2 wages. If F can elect to aggregate, things get MUCH better, because then Z’s W-2 wages are pulled into the formula.

Ex. F, a single taxpayer, owns 100% of X, Y, and Z. None have UBIA, but each have QBI and wages as follows:

- X – QBI of $1,000,000; W-2 wages of $500,000

- Y- QBI of $1,000,000; no W-2 wages

- Z-QBI of ($600,000) W-2 wages of $500,000.

F has taxable income in excess of the threshold and elects to aggregate all three businesses.

- Total QBI = $1,400,000 * 20% = $280,000.

- Total W-2 wages = $1,000,000 * 50% = $500,000.

Total deduction is $280,000, or twice the amount when there was no aggregation.

Finally, if the net result of all QBI is a loss, there is no deduction, and the loss carries forward.

Ex. F, a single taxpayer, owns 100% of X, Y, and Z. None have UBIA, but each have QBI and wages as follows:

- X – QBI of $1,000,000; W-2 wages of $500,000

- Y- QBI of $1,000,000; no W-2 wages

- Z-QBI of ($2,150,000) W-2 wages of $500,000.

F has taxable income in excess of the threshold and does not elect to aggregate all three businesses.

Total QBI is ($150,000). F gets no 199A deduction and the $150,000 loss carries over. The W-2 wages, however, do not. In the next year, the $150,000 of loss is allocated among any business with positive QBI. There is no rule that says the loss must first be allocated against income from Z.

Loose Ends

All that’s left is to address a few miscellaneous considerations surrounding Section 199A:

- The Section 199A deduction does not reduce a partner or shareholder’s basis in the partnership interest or stock.

- The deduction does not reduce net earnings from self-employment or net investment income tax.

- The same Section 199A deduction for regular tax purposes is allowed for AMT purposes.

- The threshold for the accuracy related penalty under Section 6662 for anyone claiming the Section 199A deduction is reduced so that it applies to any understatement that exceeds the greater of $5,000 or 5% of the tax required to be shown on the return (it is normally 10%).

Disclosure Requirements

A pass-through entity is required to allocate and disclose QBI, W-2 wages, and UBIA of property. If any one item is not allocated, that item is presumed to be zero. There is no exception for pass-through entities that know that all of its owners have taxable income below the thresholds.

In addition, a pass-through entity is required to disclose whether it has multiple trades or businesses, and if any of those businesses are an SSTB.

Summary

You’ve been reading for 12,000 words. Do you really need a summary? Get to work.Follow me on Twitter.

Read What To Ask Your Tax Advisors About The New Section 199A Regulations

Tony Nitti Contributor. Posted on Forbes 20th January 2019

I am a Tax Partner with RubinBrown in Aspen, Colorado. I am a CPA licensed in Colorado and New Jersey, and hold a Masters in Taxation from the University of Denver. My specialty is corporate and partnership taxation, with an emphasis on complex mergers and acquisitions structuring.

In my free time, I enjoy driving around in a van with my dog Maci, solving mysteries. I have been known to finish the New York Times Sunday crossword puzzle in less than 7 minutes, only to go back and do it again using only synonyms. I invented wool, but am so modest I allow sheep to take the credit. Dabbling in the culinary arts, I have won every Chili Cook-Off I ever entered, and several I haven’t. Lastly, and perhaps most notably, I once sang the national anthem at a World Series baseball game, though I was not in the vicinity of the microphone at the time.

- ©2019 Forbes Media LLC. All Rights Reserved